SERVICES

Capital Raising

In tough times, many companies struggle with investment crises that limit their growth. At TVC, we help businesses overcome these challenges by raising strategic capital. Our approach enables companies to sell shares to international investors, expanding their reach and unlocking new growth opportunities. Here’s how we guide you through this process:

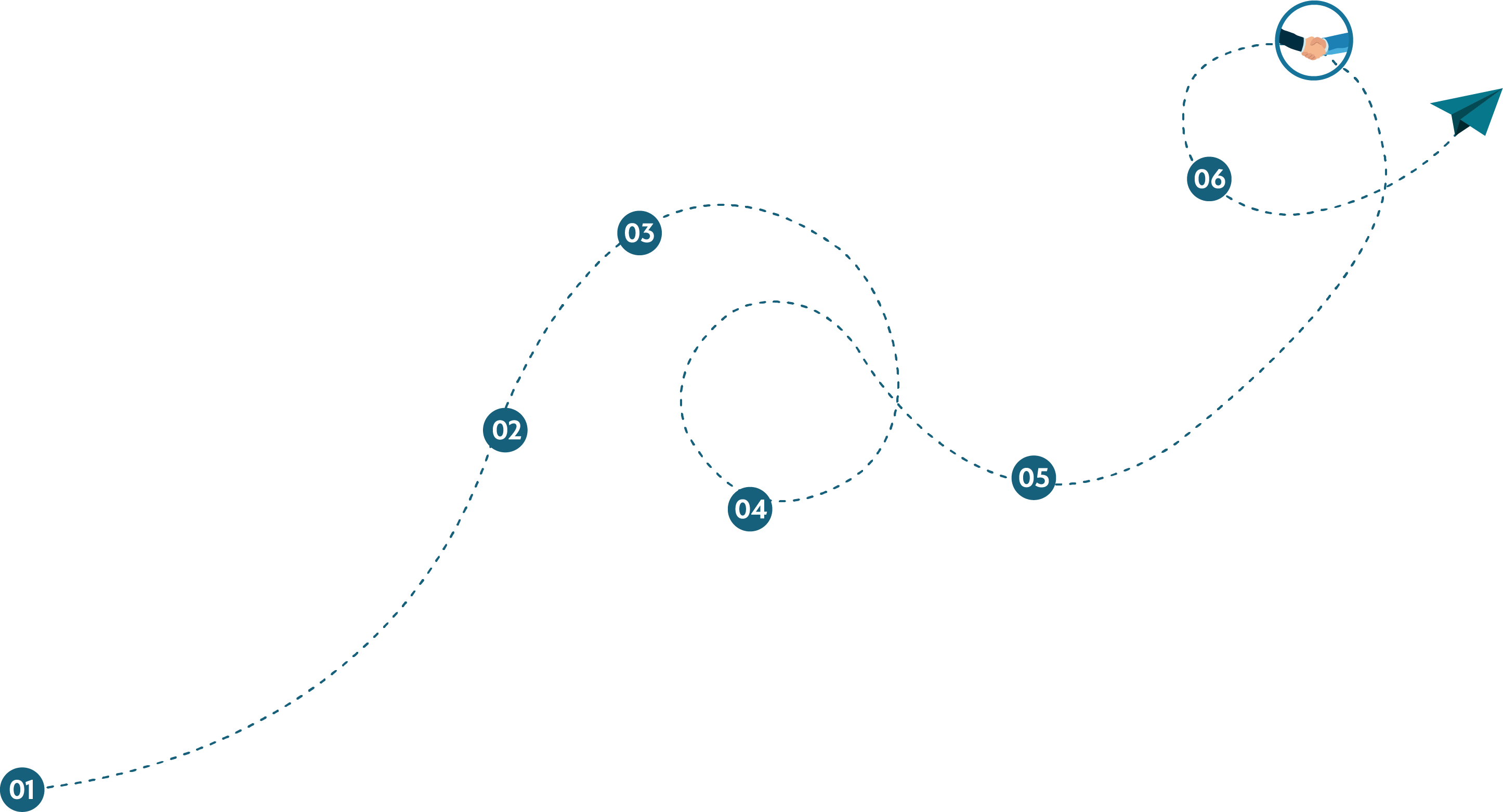

The Roadmap of Success

Capital Raising

In tough times, many companies struggle with investment crises that limit their growth. At TVC, we help businesses overcome these challenges by raising strategic capital. Our approach enables companies to sell shares to international investors, expanding their reach and unlocking new growth opportunities. Here’s how we guide you through this process:

Signing of Advisory Agreement

Provision of Materials

Consultation

Company Analysis & Research

Information Memorandum Setup

Preparation of Teaser (Anonymous)

Consultation

Provision of Materials

Signing of Advisory Agreement

Company Analysis & Research

Preparation of Teaser (Anonymous)

Information Memorandum Setup

Why Choose Us?

Selection of Target Companies

Identifying Potential Targets

Cross-Border M&A

Negotiation with Potential Targets

Global Expertise

Contract Conclusion Support

Expert Consultation

Optimal Scheme Selection

In cross-border M&A, we coordinate transactions with relevant parties in each country through our global network.