- Indonesia

Strategic Options for

Business Expansion

in Indonesia

As Indonesia’s market expands, business owners face new decisions, scale alone, or grow with the right partners.

Unlock growth beyond internal limits without overloading operations.

Unlock growth beyond internal limits without overloading operations.

Prepare your business for global partnerships and market access.

MARKET CONTEXT

Indonesia is growing

fast and owner

capability must evolve

The market is evolving rapidly. Strategic decisions matter more than reactive growth.

Why Growing Faster Feels Harder

Rapid growth creates pressure that goes beyond daily operations.

- Expansion Outpacing Capacity

Internal systems struggling to keep up with market demand.

- Expansion Outpacing Capacity

Internal systems struggling to keep up with market demand.

- Expansion Outpacing Capacity

Internal systems struggling to keep up with market demand.

- Expansion Outpacing Capacity

Internal systems struggling to keep up with market demand.

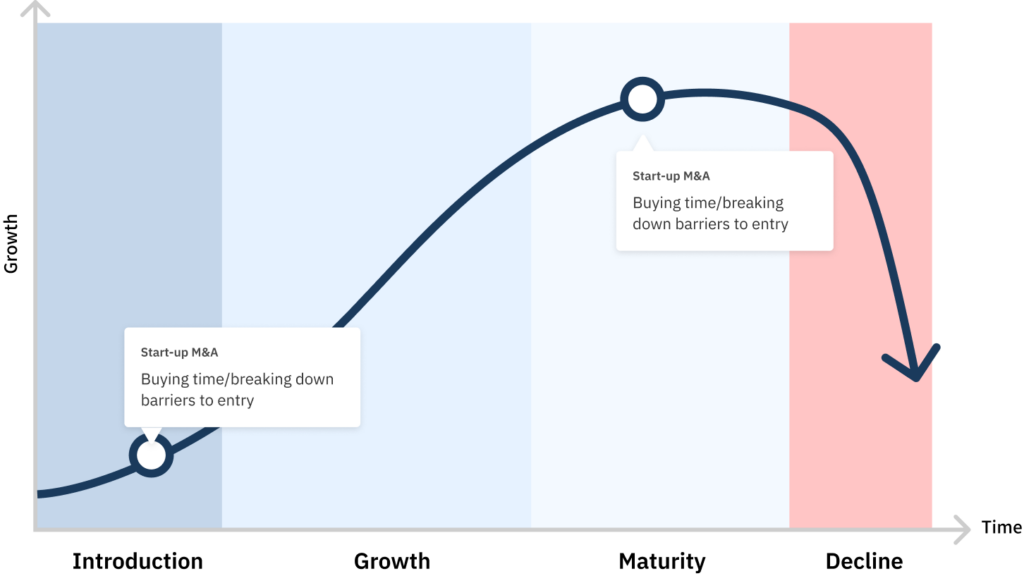

Corporate life cycle and timing for M&A consideration

- Indonesia

What Investors are looking

Understanding buyer interest helps you make informed decisions about your business’s future.

ID-S-03

AgriTech – On-Demand Farming & Smart Agriculture Platform

Scaling capital requirement. Strategic partnership for agricultural ecosystem expansion.

ID-S-02

Fintech – Circular Finance & Micro-Investment Platform

Need capital to scale regulated financial ecosystem. Strategic acquisition

ID-S-01

IT Education, Corporate Training & Digital Talent Development

Founder/investor exit or partial exit to scale faster. Need

Exploring M&A as a

Growth Option

Different structures to support expansion and stability

- Business Partnerships

Different structures to support expansion and stability

- Capital Alliances

Different structures to support expansion and stability

- Foreign Investment

Accelerate growth with international capital and networks

From Decision to Execution

M&A frameworks are used as tools, not outcomes. We structure deals that match your personal and business goals.

- Minority Investments

Capital injection without giving up control.

- Strategic Partnerships

Joint ventures for specific market goals.

- Partial Transitions

De-risk your wealth while staying involved.

- Full Ownership Transitions

Complete exit when the timing is right.

- Bridging Indonesia & the World

“Tokyo Venture Capital combines global deal experience with deep understanding of the Indonesian market to support business owners through strategic growth and transition.”

- Bridging Indonesia & the World

“Tokyo Venture Capital combines global deal experience with deep understanding of the Indonesian market to support business owners through strategic growth and transition.”

A Simple, Confidential First Step

A clear, structured approach to understanding your needs and delivering strategic guidance.

- 01

Inquiry & Free

Consultation

- Key Action

Define objectives, deal feasibility, and strategic direction.

- 02

NDA Execution

- Key Action

Establish confidentiality and secure information exchange.

- 03

Situation

Assessment

- Key Action

Analyze the business and prepare an anonymized teaser.

- 04

M&A Strategy

Proposal

- Key Action

Present a tailored transaction roadmap and execution plan.

Contact

Whether you are considering selling, acquiring, or exploring strategic investment options, the first step is a conversation.

Share your objectives with us, and our M&A specialists will assess your situation, identify viable opportunities, and outline a clear, confidential path forward.