M&A Landscape & TVC

Get Started with M&A

M&A Advisory

Capital Raising & Share Selling

Due Diligence

Legal & Regulatory Compliance

About Merger & Acquisition

Our experienced M&A advisors help navigate opportunities from sourcing potential acquisition targets to executing tailored financing solutions to fund the transaction. With the agility of an M&A boutique and relationships with a broad range of on-shore and off-shore financial institutions, we are a trusted partner to businesses. Our knowledge of industries and the regulatory framework in Bangladesh enables us to guide clients through every step of the process.

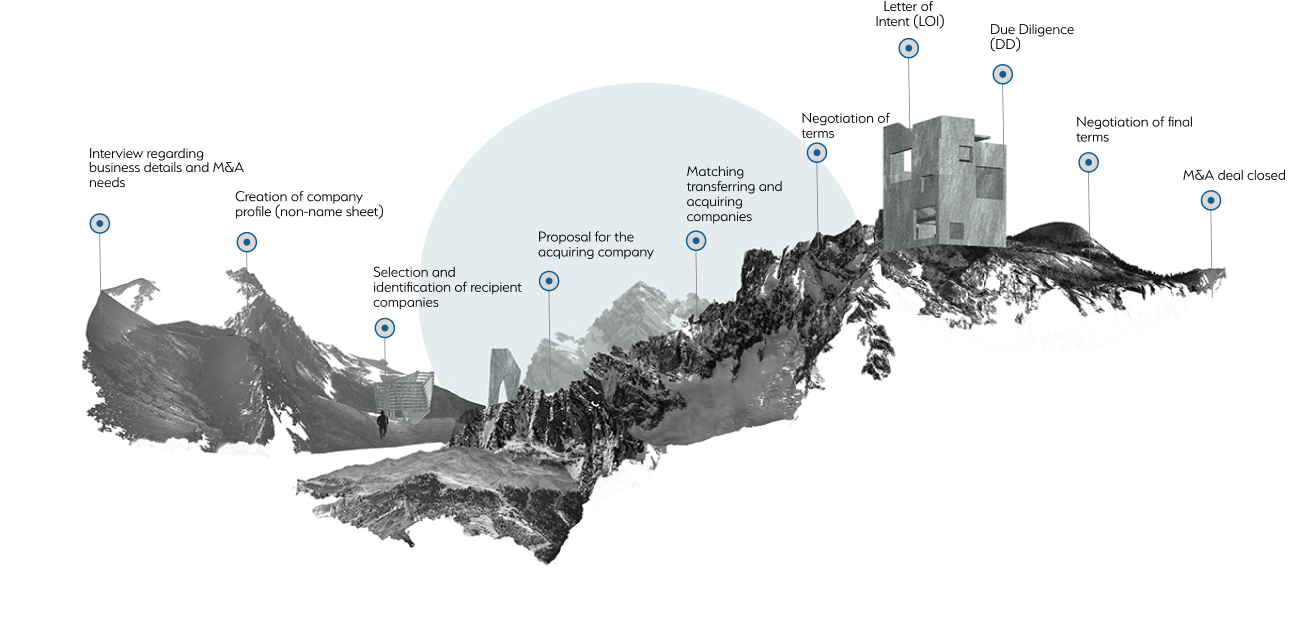

The Roadmap to Successful M&A

Our experienced M&A advisors help navigate opportunities from sourcing potential acquisition targets to executing tailored financing solutions to fund the transaction. With the agility of an M&A boutique and relationships with a broad range of on-shore and off-shore financial institutions, we are a trusted partner to businesses. Our knowledge of industries and the regulatory framework in Bangladesh enables us to guide clients through every step of the process.

The Chairman Quotes

How We Make the Difference

Financial stability is key to our success. Over the past years, our growth metrics have been impressive, with a consistent increase in revenue and profitability. This solid foundation allows us to invest in future innovations and expansions.

We invite you to join us on this exciting journey. Together, we can make a difference. Thank you for your continued support and trust in Tokyo Venture Capital. For more information, visit our website or contact us at the details provided.

Request a Proposal

Our Group Portfolio

Get Introduced with our Group

With 26 years of global expertise, Tokyo Consulting Group offers a complete “One-Stop Service” for all financial needs. Our independent firms across 26 countries deliver personalized solutions with local insights, ensuring your business thrives internationally.

Market Leader For

27 Years

We proudly stand upon a foundation built over 26 years of unwavering commitment and collaboration with our valued clients.

Our Global Family

We proudly stand upon a foundation built over 26 years of unwavering commitment and collaboration with our valued clients.

Incorporated

1998

We Started our Journey in July 1998 and we are continue to grow and

support the businesses all over the world

A Place to Live in

The philosophy of work is more than just a work for us, we only be satisfied seeing our clients be successful, it is not a work for us, we are passionate.

Global Operations

26 Countries 39 Branches

Experience the Japanese Service quality for your business operations

in 26 counties with our international consultants and wide range of localization with 44 branches

Our Global Reach & Business Areas

Discover Contents by Selecting a Country

With 26 years of global expertise, Tokyo Consulting Group offers a complete “One-Stop Service” for all financial needs. Our independent firms across 26 countries deliver personalized solutions with local insights, ensuring your business thrives internationally.

Not Found your Operation Company ?

We have operations in all over the world and more than 200+ partners to ensure the same service qualities